-

- PCB TYPE

- PRINTED CIRCUIT BOARD PROTOTYPE ALUMINUM PRINTED CIRCUIT BOARD R&F PCB FPC HIGH FREQUENCY PCB HIGH-TG PCB HEAVY COPPER PCB HDI PCB PCB FOR LIGHTING METAL CORE PCB

time:Sep 08. 2025, 14:23:37

A PCB manufacturer is a critical catalyst in the global electronics ecosystem, translating complex circuit designs into functional components that power devices from household appliances to industrial machinery. Unlike regional giants or niche specialists, PCB manufacturers worldwide share a common mandate: to balance precision, scalability, and reliability while adapting to rapid technological shifts. From small-scale prototype producers to multinational enterprises, these manufacturers collectively shape the industry’s trajectory, driving advancements in connectivity, energy efficiency, and miniaturization.

In today’s interconnected market, PCB manufacturers must navigate a dynamic landscape—balancing regional demand variations, adhering to diverse regulatory standards, and integrating emerging technologies like AI and sustainable materials. This article explores the global diversity of PCB manufacturers, their evolving capabilities, response to industry disruptions, and the key factors defining successful partnerships in a fragmented yet interconnected market.

PCB manufacturing is a globally distributed industry, with regional players specializing in distinct market segments, reflecting local industrial strengths and demand drivers.

Asia-Pacific dominates global PCB production, accounting for over 80% of output, with manufacturers in China, South Korea, and Taiwan leading in volume and diversification:

Mass Production Excellence: Chinese manufacturers excel in high-volume, cost-effective production for consumer electronics and automotive sectors, leveraging mature supply chains and economies of scale to meet tight deadlines.

High-Tech Specialization: South Korean and Taiwanese manufacturers focus on advanced PCBs, including HDI (High-Density Interconnect) designs for semiconductors and 5G equipment, prioritizing precision and material innovation.

Agile Responsiveness: Regional manufacturers rapidly adapt to trends like foldable devices and IoT sensors, often launching prototype-to-production cycles in weeks rather than months.

North American PCB manufacturers thrive in specialized, high-reliability sectors, emphasizing quality over volume:

Aerospace and Defense Leadership: Companies in the U.S. and Canada dominate the production of ruggedized PCBs for military avionics and space systems, adhering to strict standards like MIL-PRF-31032 and AS9100.

Medical Device Collaboration: Manufacturers partner closely with medical firms to produce biocompatible, low-noise PCBs for imaging equipment and implantable devices, complying with FDA and ISO 13485 requirements.

Prototyping and Low-Volume Production: Smaller U.S. firms specialize in rapid prototyping for startups, offering design feedback and iterative testing to refine PCB layouts for emerging technologies like quantum computing.

European PCB manufacturers are defined by their focus on automotive electronics and environmental stewardship:

Automotive Grade Innovation: German and Czech manufacturers lead in producing PCBs for electric vehicles (EVs) and advanced driver-assistance systems (ADAS), integrating features like thermal management and EMI shielding to meet IATF 16949 standards.

Sustainability Integration: European firms prioritize eco-friendly practices, using recycled copper, halogen-free substrates, and energy-efficient production lines to align with EU regulations like RoHS 2.0 and the Circular Economy Action Plan.

Collaborative Ecosystems: Manufacturers partner with regional automakers and research institutions (e.g., Fraunhofer Institute) to co-develop PCBs for next-gen mobility, such as autonomous vehicle control systems.

Modern PCB manufacturers are leveraging digital tools to redefine efficiency, precision, and collaboration, moving beyond traditional production paradigms.

Virtual Prototyping: Using 3D modeling and finite element analysis (FEA), manufacturers simulate PCB performance under thermal, mechanical, and electrical stress, reducing the need for physical prototypes by up to 40%.

DFM 2.0: Advanced Design for Manufacturability (DFM) software integrates real-time production data, enabling manufacturers to flag design issues—such as suboptimal trace spacing or via placement—during the design phase, lowering post-production defects.

Cloud-Based Collaboration: Platforms like Altium 365 allow manufacturers, designers, and clients to share files and feedback in real time, streamlining revisions for global teams across time zones.

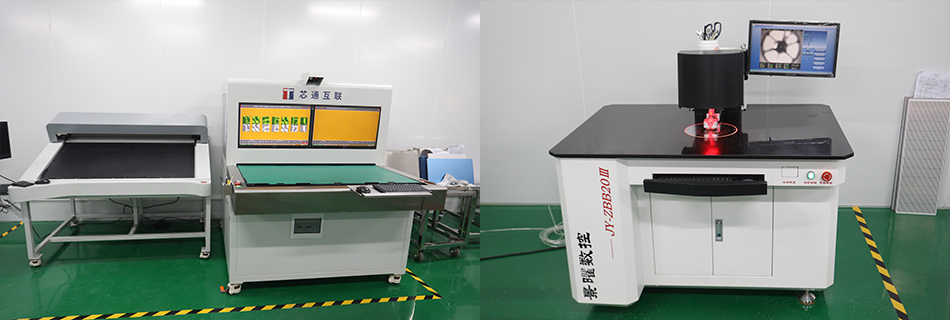

IoT-Enabled Production Lines: Sensors embedded in drilling machines, laminators, and inspection tools collect data on equipment performance, enabling predictive maintenance and reducing unplanned downtime by 25–30%.

AI-Driven Quality Control: Machine learning algorithms analyze AOI (Automated Optical Inspection) images to identify defects with 99.7% accuracy, outperforming manual inspection and adapting to new defect patterns over time.

Digital Twins: Virtual replicas of production lines mirror real-world operations, allowing manufacturers to test process changes—such as adjusting solder paste application—without disrupting active production.

Blockchain Traceability: Pilot projects use blockchain to record material origins, production steps, and test results, providing immutable records for industries like aerospace where component provenance is critical.

Demand Sensing: AI algorithms analyze market trends, client order patterns, and raw material prices to forecast demand, enabling manufacturers to adjust inventory levels and production schedules proactively.

PCB manufacturers tailor their offerings to address the unique demands of key sectors, combining technical expertise with deep industry knowledge.

Ruggedized Designs: Manufacturers produce PCBs with conformal coatings and wide operating temperature ranges (-55°C to 125°C) for PLCs, sensors, and robotics, ensuring reliability in dusty or humid factory environments.

High-Current Capability: Thick copper PCBs (3oz–10oz) support the high power requirements of motor drives and energy management systems, reducing resistive losses and improving efficiency.

Long-Term Availability: Committed to 10+ years of production support, matching the long lifecycle of industrial equipment and avoiding costly downtime caused by PCB production stoppages redesigns。

Example: A European PCB manufacturer developed a 10-layer PCB for a factory robot controller, incorporating vibration-resistant component mounting and EMI shielding. The design withstood 50,000 hours of continuous operation in a metalworking plant with zero failures.

Miniaturization Excellence: Manufacturers achieve sub-0.1mm trace widths and micro-vias for smartphones and wearables, enabling higher component density without compromising signal integrity.

Cost-Optimized Production: High-volume lines use automated component placement and inline testing to balance quality and affordability, critical for price-sensitive markets like entry-level smartphones.

Material Innovation: Experimenting with flexible substrates (e.g., polyimide blends) for foldable devices, ensuring durability through 100,000+ bend cycles.

Solar Inverter PCBs: Designed to handle high voltages (up to 1500V) and thermal cycling, with specialized substrates that resist UV degradation and moisture ingress.

Wind Turbine Controls: PCBs for pitch and yaw systems integrate redundant circuits and lightning protection, ensuring operation in remote, harsh environments.

Case Study: A U.S.-based manufacturer partnered with a solar energy firm to develop a PCB for utility-scale inverters. The design included heat sinks integrated into the PCB structure, reducing thermal resistance by 30% and improving inverter efficiency by 1.2%.

Despite their adaptability, PCB manufacturers face persistent challenges that require strategic innovation to overcome.

Raw Material Shortages: Fluctuations in copper, resin, and rare earth metal prices—exacerbated by geopolitical tensions—force manufacturers to diversify suppliers and invest in material substitution research (e.g., aluminum-core PCBs as a copper alternative).

Logistics Disruptions: Global shipping delays drive regionalization of supply chains, with manufacturers establishing local hubs in key markets (e.g., Mexico for North American automotive clients) to reduce lead times.

Divergent Standards: Navigating varying regulations—such as China’s RoHS-like standards, EU’s REACH, and U.S. ITAR—requires manufacturers to implement modular production lines that can adapt to regional requirements.

Emerging Environmental Mandates: Increasing pressure to eliminate PFAS (per- and polyfluoroalkyl substances) in solder masks and coatings pushes R&D into bio-based alternatives, with some manufacturers achieving 90% reduction in hazardous chemical use.

Specialized Labor Shortages: A shortage of engineers trained in HDI fabrication and AI-driven quality control leads manufacturers to partner with technical schools and offer on-the-job training programs.

Digital Skills Demand: Recruiting data scientists and IoT specialists to manage smart factories, with some firms establishing in-house academies to upskill existing workforce.

Choosing the right PCB manufacturer requires evaluating factors beyond cost and capacity, focusing on long-term partnership potential.

Specialization Match: Prioritize manufacturers with proven expertise in your industry (e.g., medical vs. consumer electronics) and a track record of solving similar design challenges.

Innovation Readiness: Assess investments in R&D and digital tools—manufacturers using AI for DFM or blockchain for traceability are better equipped to handle future demands.

Supply Chain Visibility: Select manufacturers that provide real-time access to production data and can demonstrate contingency plans for material shortages or logistics disruptions.

Scalability Flexibility: Evaluate ability to transition from prototype to mass production seamlessly, with modular lines that adjust to volume fluctuations.

Certification Depth: Look for manufacturers with certifications beyond basics (e.g., IPC-6012 for rigid PCBs) and third-party audit records demonstrating consistent compliance.

Testing Capabilities: Ensure in-house testing for your application’s critical parameters (e.g., thermal shock for automotive, signal integrity for 5G).

PCB manufacturers worldwide are united by their role as enablers of technological progress, yet diversified by regional strengths, industry focuses, and innovation priorities. From Asia’s mass production efficiency to North America’s niche precision, these manufacturers collectively drive the electronics industry forward, adapting to challenges through digital transformation, sustainable practices, and collaborative ecosystems.

As devices become smarter, more connected, and more sustainable, the role of PCB manufacturers will evolve from production partners to innovation co-creators. Success will hinge on their ability to integrate emerging technologies, navigate global complexities, and forge partnerships built on transparency and technical alignment. For businesses, selecting the right manufacturer means looking beyond capabilities—to a shared vision for resilience, quality, and future readiness in an ever-evolving market.

Got project ready to assembly? Contact us: info@apollopcb.com

We're not around but we still want to hear from you! Leave us a note:

Leave Message to APOLLOPCB