-

- PCB TYPE

- PRINTED CIRCUIT BOARD PROTOTYPE ALUMINUM PRINTED CIRCUIT BOARD R&F PCB FPC HIGH FREQUENCY PCB HIGH-TG PCB HEAVY COPPER PCB HDI PCB PCB FOR LIGHTING METAL CORE PCB

time:Sep 08. 2025, 14:14:30

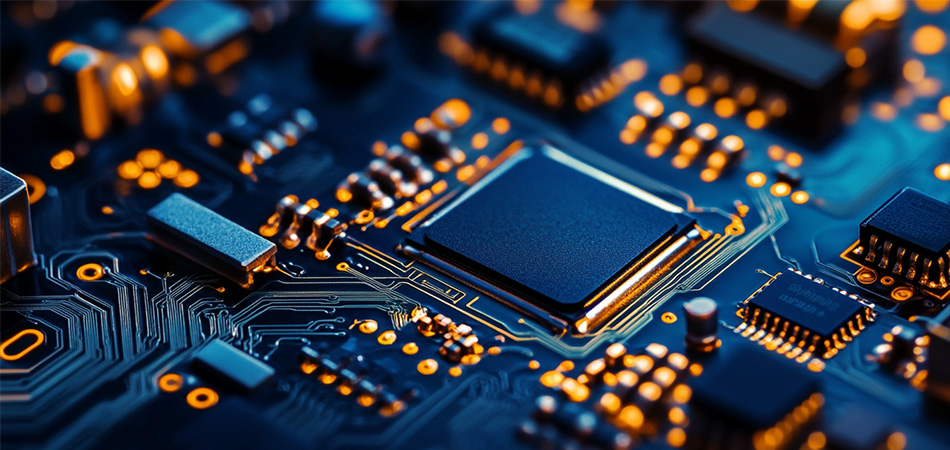

China’s PCB manufacturing giants stand at the forefront of the global electronics supply chain, collectively accounting for over half of the world’s printed circuit board production. These industry leaders have evolved from contract manufacturers to innovation hubs, driving advancements in PCB technology, scaling production capabilities, and shaping trends across consumer electronics, automotive, renewable energy, and aerospace sectors. Beyond sheer volume, their influence lies in integrating cutting-edge manufacturing with vertical supply chain control, rapid scalability, and adherence to global quality standards. This article explores the defining characteristics, strategic strengths, and industry impact of the top 10 China PCB manufacturing giants, highlighting their role in enabling global technological progress and setting benchmarks for reliability, efficiency, and innovation.

The leading PCB manufacturers in China share a set of strategic capabilities that distinguish them from regional players and solidify their global position. These strengths underpin their ability to serve multinational clients and adapt to dynamic market demands.

China’s PCB giants operate sprawling manufacturing complexes with hundreds of production lines, enabling them to handle volumes from prototype runs to millions of units monthly. This scale allows for economies of scale in material sourcing, equipment utilization, and labor efficiency, translating to competitive pricing without compromising quality. For example, a single giant can produce over 100 million square meters of PCBs annually, covering everything from 2-layer standard boards to 50+ layer high-density interconnect (HDI) designs.

Unlike smaller manufacturers, these giants control critical stages of the supply chain—from copper foil and substrate production to PCB assembly and testing. This integration reduces dependency on external suppliers, shortens lead times, and enhances quality control. Many operate in industrial clusters (e.g., in Guangdong, Jiangsu, and Zhejiang provinces), where upstream material suppliers and downstream assembly partners are co-located, creating efficient manufacturing ecosystems.

Top China PCB giants allocate significant resources to research and development, focusing on next-generation technologies such as:

High-Density Interconnect (HDI): Enabling finer trace widths, micro-vias, and higher layer counts for compact devices like 5G smartphones and IoT sensors.

Flexible and Rigid-Flex PCBs: Catering to foldable electronics, wearable tech, and automotive applications requiring conformable designs.

Low-Loss Materials: Developing PCBs with advanced substrates for high-frequency applications (e.g., 6G infrastructure and satellite communications).

Their R&D centers often collaborate with universities and global tech firms to patent innovations, ensuring they stay ahead in technology races.

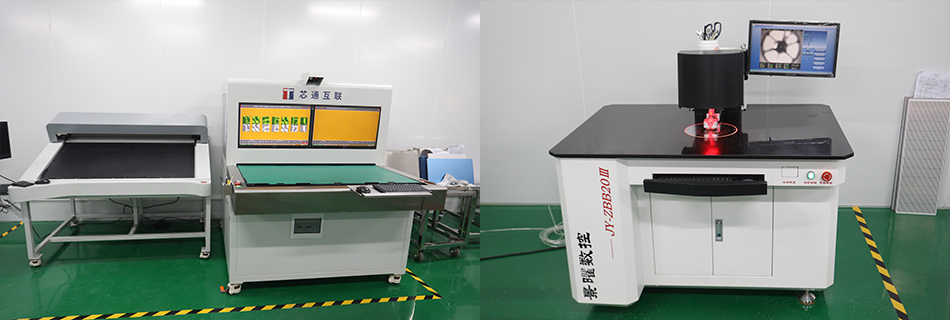

To serve industries like automotive, medical, and aerospace, these manufacturers adhere to stringent international standards, including IATF 16949, ISO 13485, AS9100, and UL certifications. They implement rigorous testing protocols—from automated optical inspection (AOI) to thermal cycling and vibration tests—ensuring PCBs meet reliability requirements for critical applications. Many have also achieved RoHS, REACH, and conflict mineral compliance, aligning with global sustainability and ethical sourcing mandates.

China’s top PCB manufacturers tailor their capabilities to serve diverse sectors, leveraging their scale and technology to meet industry-specific demands.

As primary suppliers to global smartphone, laptop, and smart device brands, these giants excel in producing high-volume, high-precision PCBs. They specialize in HDI boards for compact designs, integrating components like 5G modems and AI chips. Their ability to ramp up production within weeks supports the fast-paced launch cycles of consumer electronics, where time-to-market is critical.

With the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), China’s PCB giants have become key partners to automotive OEMs. They produce PCBs resistant to extreme temperatures, vibration, and chemical exposure, meeting ISO 26262 functional safety standards. EV battery management systems (BMS), infotainment units, and sensor modules rely on their high-reliability boards, with some giants dedicating entire factories to automotive PCB production.

Solar inverters, wind turbine controllers, and industrial automation equipment require PCBs that handle high voltages and harsh environments. China’s PCB leaders supply these sectors with thick-copper PCBs for power distribution, heat-resistant substrates, and ruggedized designs. Their ability to produce large-format boards (over 1 meter in length) supports the scalability of renewable energy installations.

Aerospace-grade PCBs demand low weight, high reliability, and resistance to radiation and extreme pressure. Several top China manufacturers have secured certifications for aerospace applications, producing boards for satellite communications, avionics, and defense systems. Their investment in cleanroom manufacturing and traceability systems ensures compliance with strict aerospace regulations.

China’s PCB manufacturing giants have transcended domestic borders, establishing a global footprint to serve clients and mitigate supply chain risks.

To reduce logistics costs and navigate trade regulations, many giants have built factories in Southeast Asia, Mexico, and Eastern Europe. These facilities mirror the technology and quality standards of their Chinese plants, enabling localized production for regional markets (e.g., serving U.S. automotive clients from Mexican facilities).

Collaboration is central to their growth strategy. They partner with semiconductor companies, electronics OEMs, and material suppliers to co-develop PCBs for emerging technologies. For example, joint projects with 5G equipment makers have led to innovations in low-loss RF PCBs, while partnerships with EV battery producers have optimized BMS board designs.

Recognizing the volatility of electronics markets, top giants diversify across industries. A manufacturer heavily reliant on smartphone PCBs might also expand into automotive and renewable energy sectors, balancing demand fluctuations and ensuring steady growth.

China’s PCB leaders are prioritizing sustainability and green manufacturing to align with global carbon neutrality goals and secure long-term partnerships with eco-conscious clients.

Investments in renewable energy (solar panels, wind turbines) for factories, wastewater recycling systems, and lead-free manufacturing processes reduce their environmental footprint. Some giants have pledged to achieve carbon neutrality in production by 2035, using carbon offset programs and energy-efficient equipment to meet targets.

Recycling programs for copper, substrates, and chemicals recover valuable materials from production waste, reducing reliance on virgin resources. This not only lowers costs but also addresses growing client demands for sustainable supply chains.

Research into bio-based substrates, graphene-enhanced copper traces, and additive manufacturing (3D-printed PCBs) is underway, with several giants already piloting these technologies. These innovations aim to improve performance (e.g., thermal conductivity) while reducing environmental impact.

For global clients seeking reliable PCB suppliers, the top China giants offer distinct advantages, but selecting the right partner requires evaluating specific factors:

While most giants serve multiple sectors, some excel in niche areas (e.g., one may lead in automotive PCBs, another in aerospace). Clients should align with manufacturers with proven expertise in their target industry.

Assessing a giant’s track record in advanced technologies (HDI, flexible PCBs, high-frequency designs) ensures they can support future product iterations, not just current needs.

The ability to manage material shortages, geopolitical risks, and logistics disruptions is critical. Giants with vertical integration and global manufacturing hubs offer greater supply chain stability.

Effective partnership requires clear communication, dedicated account management, and responsiveness to design changes. Top giants invest in multilingual teams and digital platforms for real-time project tracking.

China’s top 10 PCB manufacturing giants are more than just large-scale producers—they are architects of the global electronics ecosystem. Their combination of scale, technology, and strategic foresight enables the development of cutting-edge devices, from smartphones to EVs and renewable energy systems. By prioritizing innovation, sustainability, and global compliance, these giants continue to set industry standards, driving progress while adapting to evolving market demands. For businesses seeking reliable, forward-thinking PCB partners, these industry leaders offer the expertise and capabilities to turn technological visions into tangible, high-quality products—solidifying China’s role as a cornerstone of the global electronics supply chain for decades to come.

Got project ready to assembly? Contact us: info@apollopcb.com

We're not around but we still want to hear from you! Leave us a note:

Leave Message to APOLLOPCB